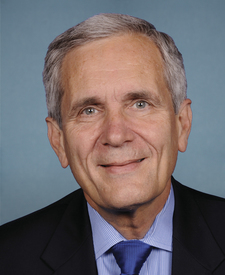

Lloyd Doggett

AnalysisD TX-37 · House

Industry Impact Profile

11525 industry impacts

Industries Helped

Industries Burdened

Click any row to see supporting clauses

Voting Alignment by Industry

| Industry | S+ | S- | O+ | O- | Net |

|---|---|---|---|---|---|

Government (70 sub)

Sub-categories (total impacts, all buckets):

Defense (176),

Veterans Affairs (130),

Coast Guard (36),

DoD (33),

Legislative (27)

+65 more

|

-386 | ||||

Military (4 sub)

Sub-categories (total impacts, all buckets):

Intercontinental Ballistic Missile Systems (3),

Air Force (2),

Families (1),

Space Force (1)

|

-83 | ||||

General Public (9 sub)

Sub-categories (total impacts, all buckets):

Veterans (100),

Military Families (11),

Family Sponsors (4),

Foreign (2),

Military (2)

+4 more

|

-184 | ||||

Defense (14 sub)

Sub-categories (total impacts, all buckets):

Naval (2),

Nuclear (2),

Testing (2),

Ammunition (1),

Ground Vehicles (1)

+9 more

|

-112 | ||||

| Cryptocurrency | - | - | -71 | ||

Transportation (5 sub)

Sub-categories (total impacts, all buckets):

Foreign (2),

Labor (2),

Technology (2),

Tourism (2),

Moving (1)

|

-8 | ||||

Healthcare (6 sub)

Sub-categories (total impacts, all buckets):

Research (9),

Community (2),

Family Planning Services (2),

Public Health (2),

Specialized Services (2)

+1 more

|

-31 | ||||

Education (5 sub)

Sub-categories (total impacts, all buckets):

Child Care (2),

Maritime Training (2),

Immigrant Students (1),

Religious Studies (1),

Technical (1)

|

-46 | ||||

Financial Services (1 sub)

Sub-categories (total impacts, all buckets):

Public Issuers (4)

|

-64 | ||||

Manufacturing (4 sub)

Sub-categories (total impacts, all buckets):

Foreign (7),

Electrical Equipment (2),

Defense (1),

Foreign Adversary (1)

|

-20 | ||||

Immigration (2 sub)

Sub-categories (total impacts, all buckets):

Unaccompanied Minors (4),

Undocumented (3)

|

- | +105 | |||

| Taxpayers | - | - | -33 | ||

Agriculture (6 sub)

Sub-categories (total impacts, all buckets):

Livestock (3),

Coffee (2),

Commodities (2),

Hemp (2),

Coffee Production (1)

+1 more

|

- | - | -119 | ||

Construction (4 sub)

Sub-categories (total impacts, all buckets):

Federal Projects (1),

Federal/Military (1),

Military/Pacific (1),

Utilities/Infrastructure (1)

|

- | -74 | |||

Technology (14 sub)

Sub-categories (total impacts, all buckets):

Foreign (7),

Cybersecurity (3),

Blockchain/DLT (2),

AI/Defense (1),

Artificial Intelligence (1)

+9 more

|

+4 |

Loading votes...

Sponsored & Cosponsored Bills

hr6183-119

Primary Sponsor IntroducedTo amend the Internal Revenue Code of 1986 to reform certain rules related to health savings accounts.

hr5374-119

Primary Sponsor IntroducedTo ensure that health professions opportunity demonstration projects train project participants to earn a recognized postsecondary credential, and to clarify that community colleges are eligible for grants to conduct such a demonstration project.

hr4559-119

Primary Sponsor IntroducedTo amend title XVIII of the Social Security Act to establish payment parity between Medicare Advantage and fee-for-service Medicare, and to establish prompt payment requirements under Medicare Advantage.

hr4077-119

Primary Sponsor IntroducedGUARD Veterans’ Health Care Act

hres502-119

Primary Sponsor In CommitteeOf inquiry requesting the President and directing the Secretaries of the Treasury, Labor, and Health and Human Services to transmit, respectively, certain documents to the House of Representatives relating to the development of a centralized database by the Federal government and Palantir Technologies Inc. that compiles American citizens’ personal information across Federal agencies and departments, including confidential taxpayer, identity, wage, child support, bank account, student loan, health, medical, financial, or other information.

hr3140-119

Primary Sponsor IntroducedTo amend the Internal Revenue Code of 1986 to expand the denial of deduction for certain excessive employee remuneration, and for other purposes.

hr2543-119

Primary Sponsor IntroducedTo amend the Internal Revenue Code of 1986 to expand the exclusion of Pell Grants from gross income, and for other purposes.

hr2045-119

Primary Sponsor IntroducedTo amend title XVIII of the Social Security Act to provide for coverage of dental, vision, and hearing care under the Medicare program.

hr1918-119

Primary Sponsor IntroducedTo prohibit the sale and distribution of expanded polystyrene food service ware, expanded polystyrene loose fill, and expanded polystyrene coolers, and for other purposes.

hr1784-119

Primary Sponsor IntroducedTo amend titles XI and XVIII of the Social Security Act to strengthen health care waste, fraud, and abuse provisions.

hr1785-119

Primary Sponsor IntroducedTo amend title XVIII of the Social Security Act to establish requirements for the provision of certain high-cost durable medical equipment and laboratory testing, and for other purposes.

hres127-119

Primary Sponsor In CommitteeOf inquiry requesting the President and directing the Secretary of the Treasury to transmit, respectively, certain documents to the House of Representatives relating to the Department of Government Efficiency’s access to the Treasury payment systems and confidential taxpayer information.

hr995-119

Primary Sponsor In CommitteeNo Tax Breaks for Outsourcing Act

hr930-119

Primary Sponsor IntroducedTo amend titles II and XVIII of the Social Security Act to eliminate the disability insurance benefits waiting period for individuals with disabilities, and for other purposes.

hr610-119

Primary Sponsor IntroducedTo amend title XVIII of the Social Security Act to provide for certain reforms with respect to medicare supplemental health insurance policies.

hr609-119

Primary Sponsor IntroducedTo amend the Social Security Act and the Internal Revenue Code of 1986 to include net investment income tax imposed in the Federal Hospital Insurance Trust Fund and to modify the net investment income tax.

hr608-119

Primary Sponsor IntroducedTo amend title XIX of the Social Security Act to provide for a demonstration project under the Medicaid program for political subdivisions of States to provide medical assistance for the expansion population under such program, and for other purposes.

hr3000-118

Primary Sponsor IntroducedTo amend the Internal Revenue Code of 1986 to expand the exclusion of Pell Grants from gross income, and for other purposes.

Loading countries...

Select a clause to see detailed analysis

Failed to load analysis

Please try again

Failed to load clauses

Please try again

Click an industry from the Impact Profile to view supporting clauses

Select a clause to see detailed analysis